Auto Insurance Agent In Jefferson Ga Things To Know Before You Get This

Table of Contents6 Simple Techniques For Life Insurance Agent In Jefferson GaBusiness Insurance Agent In Jefferson Ga Things To Know Before You Buy9 Easy Facts About Auto Insurance Agent In Jefferson Ga ExplainedExcitement About Business Insurance Agent In Jefferson Ga

According to the Insurance Information Institute, the average annual price for a car insurance coverage in the United States in 2016 was $935. 80. Typically, a single head-on accident can set you back thousands of dollars in losses, so having a policy will certainly set you back much less than spending for the accident. Insurance policy likewise aids you stay clear of the devaluation of your vehicle. The insurance coverage safeguards you and assists you with insurance claims that make against you in accidents. It also covers lawful prices. Some insurance coverage companies use a no-claim bonus offer (NCB) in which qualified consumers can certify for every claim-free year. The NCB could be offered as a price cut on the premium, making vehicle insurance much more economical.

Numerous variables impact the expenses: Age of the automobile: Oftentimes, an older lorry expenses much less to guarantee contrasted to a more recent one. New vehicles have a greater market price, so they set you back more to fix or change. Components are much easier to locate for older vehicles if repairs are required. Make and version of automobile: Some lorries set you back even more to guarantee than others.

Danger of theft. Certain cars on a regular basis make the regularly swiped checklists, so you could need to pay a higher costs if you have one of these. When it pertains to automobile insurance coverage, the three major kinds of policies are obligation, accident, and thorough. Obligatory obligation insurance coverage pays for damages to another driver's automobile.

All about Auto Insurance Agent In Jefferson Ga

Some states need vehicle drivers to lug this insurance coverage (https://sketchfab.com/jonfromalfa1). Underinsured vehicle driver. Similar to without insurance coverage, this plan covers problems or injuries you suffer from a vehicle driver that does not bring sufficient insurance coverage. Bike insurance coverage: This is a policy especially for bikes due to the fact that auto insurance policy does not cover motorbike mishaps. The advantages of automobile insurance far surpass the risks as you might end up paying thousands of bucks out-of-pocket for an accident you cause.

It's normally better to have more insurance coverage than inadequate.

The Social Safety And Security and Supplemental Protection Earnings impairment programs are the biggest of numerous Government programs that offer help to people with impairments (Business Insurance Agent in Jefferson GA). While these two programs are various in many methods, both are administered by the Social Security Administration and just people that have a handicap and fulfill medical standards may get benefits under either program

Use the Benefits Qualification Testing Device to discover which programs might be able to pay you benefits. If your application has just recently been denied, the Net Appeal is a starting factor to ask for a testimonial of our choice regarding your eligibility for disability advantages. If your application is denied for: Medical factors, you can finish and send the Charm Demand and Charm Impairment Report online. A succeeding analysis of workers' settlement insurance claims and the level to which absence, spirits and hiring great employees were troubles at these firms shows the favorable effects of supplying medical insurance. When contrasted to businesses that did not supply medical insurance, it shows up that offering FOCUS resulted in enhancements in the ability to hire good employees, decreases in the variety of workers' settlement cases and reductions in the level to which absence and performance were problems for FOCUS services.

Home Insurance Agent In Jefferson Ga for Dummies

Six reports have actually been launched, including "Treatment Without Protection: Insufficient, Far Too Late," which locates that working-age Americans without wellness insurance are more probable to get insufficient treatment and receive it also late, be sicker and die faster and obtain poorer care when they are in the health center, even for acute scenarios like a car crash.

The study writers also note that increasing coverage would likely cause a rise in actual resource expense (no matter of who pays), because the without insurance get concerning fifty percent as much treatment as the independently insured. Wellness Affairs published the study online: "How Much Healthcare Do the Uninsured Usage, and That Pays For It? - Business Insurance Agent in Jefferson GA."

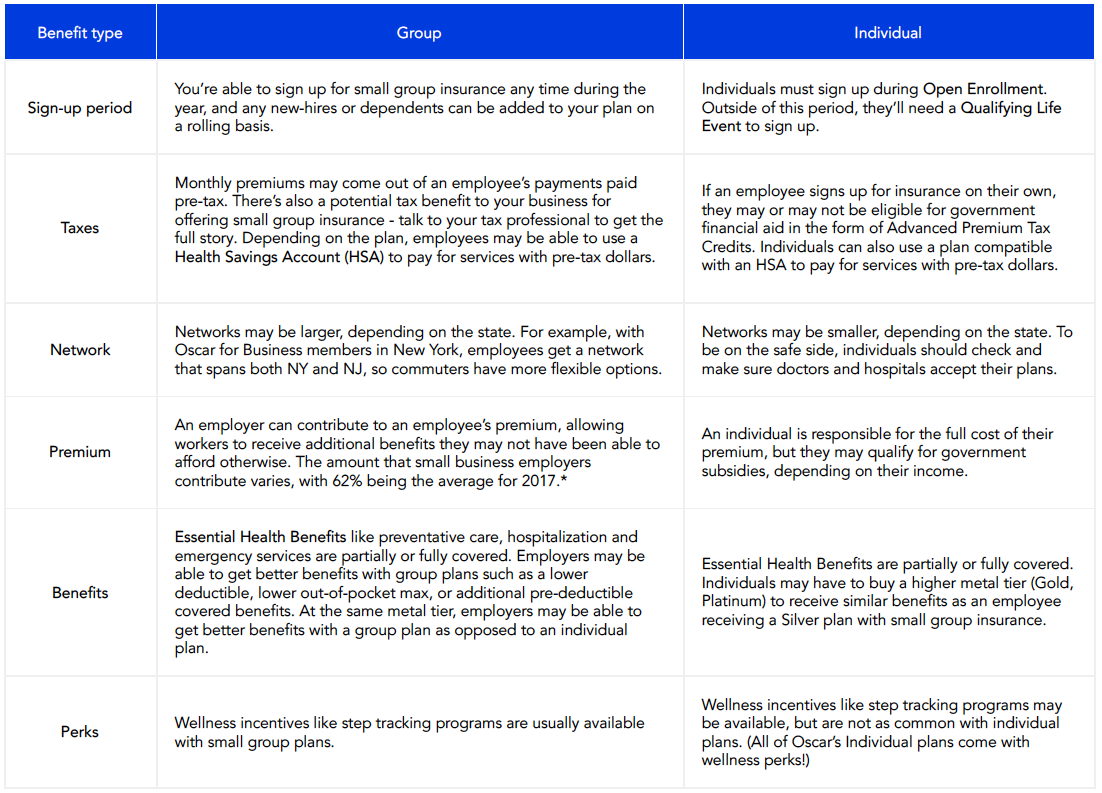

The duty of giving insurance policy for employees can be a complicated and occasionally costly job and numerous tiny services assume they can't manage it. What benefits or insurance coverage do you legitimately need to supply?

The Of Home Insurance Agent In Jefferson Ga

Worker benefits typically begin with health and wellness insurance policy and group term life insurance coverage. As part of the wellness insurance coverage bundle, a company may decide to provide both vision and oral insurance policy.

With the climbing fad in the expense of wellness insurance policy, it is reasonable to ask staff members to pay a percentage of the coverage. Many organizations do place most of the expense on the employee when they give access to health insurance policy. A retirement (such as a 401k, SIMPLE plan, SEP) is typically provided as a staff member benefit too - https://www.cybo.com/US-biz/alfa-insurance-jonathan-portillo-agency_10.